Key Economic Data Suggest Recession Could Be Possible

Mark these words: the U.S. economy could now be closer to a recession than to economic growth.

Why would someone say this at a time when key stock indices are soaring, investor sentiment is surging, economists are optimistic, and consumer sentiment is soaring?

It’s important to pay attention to data.

Keep in mind that, in most technical terminology, a recession is when the gross domestic product (GDP) declines for two consecutive quarters.

Notice the word “GDP.” It’s calculated using consumption, investment, and spending data. If the data that are used in GDP calculations start to tumble, can the economy really report growth? No.

As it stands, the data keep turning dismal. Don’t look at the stock market as an indicator of the U.S. economy. It’s very misleading.

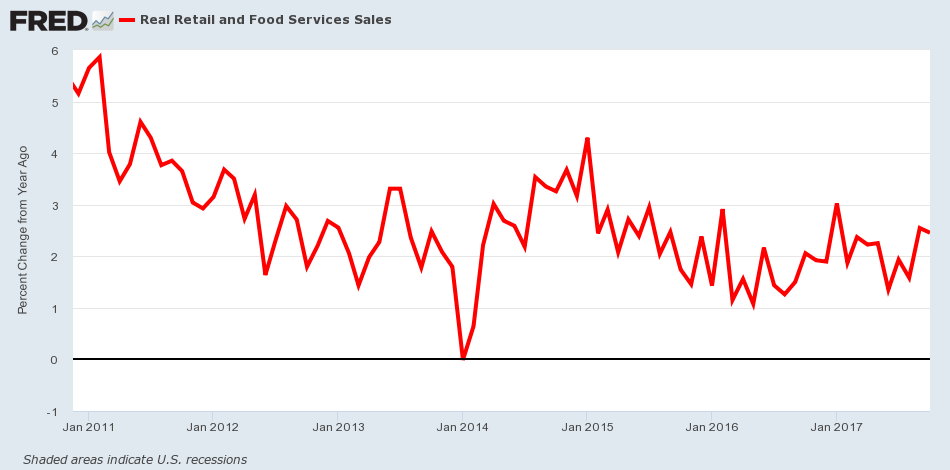

Retail Sales Growth Rates Continue to Decline

Look at the chart below, for example. Pay close attention to the overall trend. It paints a dire outlook for the U.S. economy.

The chart above shows year-over-year change in monthly retail and food services sales in the U.S. economy.

Retail and food services sales continue to deteriorate. In early 2011, they were growing at around five percent. Now the growth rate has tumbled to nearly half of that. Consumer confidence may be hitting all-time highs, but American consumers are not buying.

Why do retail sales matter? They are essentially an indicator of consumer spending. Prior to recessions, retail spending tends to deteriorate. We saw this happen before the great recession of 2007-2009 and before the recession in 2001.

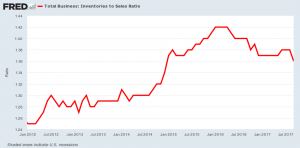

Business Inventory-to-Sales Ratio Remains Elevated

There’s one more set of data that’s really worth watching: the total business inventory-to-sales ratio. This ratio is making a compelling argument that the U.S. economy is already in a recession.

What is the business inventory-to-sales ratio? It essentially shows how many months of sales it would take to clear out the existing inventory.

Currently, the inventory-to-sales ratio stands at 1.36. It went as high as 1.42 in early 2016. You see, the last time the inventory-to-sales ratio was this high and sustained at those levels, the U.S. economy was in a recession.

U.S. Economic Outlook Going into 2018: Dull at Best

Dear reader; if you listen to the mainstream, it will have you convinced that the U.S. economy is perfectly fine and that it’s even going to grow.

Remember; data represent facts And the data here are saying there’s deterioration in the U.S. economy..and that the outlook isn’t good.

Mind you, it’s also impressive how no one is willing to talk about rising interest rates. The federal funds rate, the most basic interest rate, is expected to double in the next few years. And it’s basic economics: interest rates impact consumption and investment. Higher interest rates could be like “throwing gas on a fire.” They could speed up the economic slowdown in the U.S.

I see 2018 as a year that the word “recession” will start to gain in popularity.

I can’t help but be pessimistic towards the U.S. economy going forward. At very best, my outlook for the economy going forward is dull.

Obviously, with time, we will know more.